Meridian Credit Union Mortgage Rates & Reviews

Meridian Background

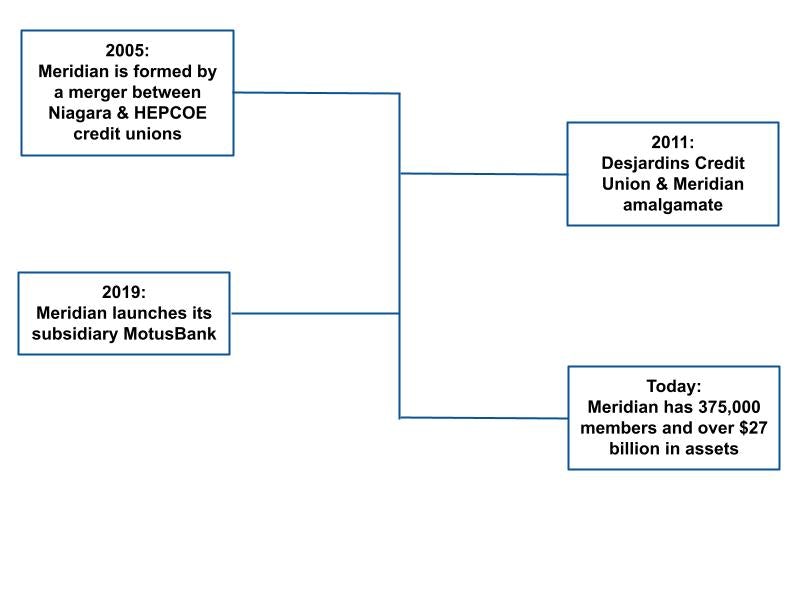

Meridian Credit Union was formed in 2005 after the merger of Niagara Credit Union and HEPCOE Credit Union. Then in 2011, Meridian grew its branch network, number of members, and assets under management by amalgamating with Desjardins Credit Union in Ontario. Meridian has its headquarters in St. Catherine’s, Ontario, and in addition to offering Meridian mortgages, the credit union offers products and services such as:

- Bank accounts,

- Credit cards,

- Lines of credit,

- Insurance,

- Wealth management, and

- Business and commercial lending

Currently, Meridian is the second-largest credit union in Canada outside of Quebec, and the largest in Ontario, with over 2,000 employees, 87 branches, and over 380,000 members.

Motusbank

Motusbank was a subsidiary of Meridian Credit Union before announcing that it would be winding down operations in 2025. If you had a lending product in Ontario with motusbank, such as a mortgage or line of credit, your loan would have been moved to Meridian by May 1, 2025. Some Ontario borrowers will see their products transitioned to Coast Capital Credit Union.

If you had a lending product outside of Ontario with motusbank or a deposit account in any province, such as a savings or chequing account, you will be moved to Coast Capital Credit Union by early 2026.

Meridian Credit Union Fixed Mortgage Rates

Getting a Meridian fixed rate mortgage allows you to take comfort knowing that even if interest rates are to rise in the future, your Meridian mortgage rate will remain the exact same throughout your term. This can give you the ability to plan in advance for how much of your mortgage balance you will pay off during your mortgage term, which is especially important on large mortgage amounts. Although over the last few decades a variable rate mortgage would have provided you with the best Meridian mortgage rate as interest rates have fallen, with interest rates at record low levels, a fixed rate Meridian mortgage may be the better option. The most common term for a fixed rate mortgage is a 5-year fixed mortgage offering.

| Term | Meridian Rate | Canada's Lowest Rate |

|---|

The rates shown are for insured mortgages with a down payment of less than 20%. You may get a different rate if you have a low credit score or a conventional mortgage. Rates may change at any time.

Meridian Credit Union Variable Mortgage Rates

A variable rate mortgage at Meridian will allow you to benefit if the prime rate falls, considering that your mortgage rate will fluctuate with the prime rate. However, if the prime rate is to rise, Meridian Credit Union mortgage rates will also rise. This means that a variable rate mortgage is a better option for someone who believes that interest rates are more likely to fall in the future. Even if your Meridian mortgage rate rises or falls, your monthly mortgage payments will not change. The only aspect about these payments that will change is how much of your monthly payment will go to interest, with more going to interest payments when rates rise, and less when they fall.

| Term | Meridian Rate | Canada's Lowest Rate |

|---|

The rates shown are for insured mortgages with a down payment of less than 20%. You may get a different rate if you have a low credit score or a conventional mortgage. Rates may change at any time.

Meridian Credit Union History

Meridian Mortgage Break Penalty

Similar to banks and other lenders, Meridian Credit Union uses a method called Interest Rate Differential(IRD) when determining your mortgage prepayment penalty. This penalty will be incurred if you break your mortgage before your term is up. Depending on the amount, your prepayment penalty will be the greater of: 3 months of interest, or the IRD amount.

| Bank or Lender | Variable Rate Mortgage | Fixed Rate Mortgage |

|---|---|---|

| 3 Months’ Interest | Greater of 3 Months’ Interest or the IRD amount |

Meridian determines the IRD amount by finding the difference between your current Meridian Credit Union mortgage rate, and the posted mortgage rate with a similar time frame remaining. This difference is then multiplied by the amount of time left on your mortgage, to determine the IRD amount.

Meridian Mortgage Prepayment Calculator

Are you looking to pay off your mortgage early? Or refinance the terms of your mortgage at a lower interest rate? Maybe you sold your home. Whatever the case, you most likely will have to pay a mortgage break penalty set by your lender. Whatever the situation, our calculator will help you determine the cost to break your mortgage so you can be confident about your mortgage decisions.

What is the remaining balance on your mortgage?

What is the term-length and type of your current mortgage?

What is your current mortgage interest rate?

If applicable, what was the rate discount you received when you signed your current mortgage agreement?

When did your current mortgage start?

Is the Property:

Who is your current mortgage lender?

What is Meridian's current interest rate for a 1-year fixed rate mortgage?

What would you like to do?

Please complete all fields before calculating.

By using the calculator, you agree to our Terms of Service

Other Meridian Mortgage Products

Besides conventional fixed and variable rate mortgages, other Meridian mortgage products include:

Meridian Hybrid Mortgage

This product combines both a traditional mortgage with a loan, as a way to help you afford to purchase a home considering your future borrowing potential. As you transition to your career and your income rises enough to afford the mortgage, your loan portion will convert to a mortgage. With a Meridian Hybrid Mortgage, you will be able to borrow up to 80% of your purchase price, with the loan portion being a maximum of 60%, and the mortgage portion being a minimum of 20%. This mortgage product is an alternative option for new Canadians, recent graduates, or even people working in the trades that are starting their career.

Meridian Self-Employed Mortgage

Considering that getting a mortgage as a business owner, entrepreneur, or contract worker can be more difficult than as a non-self-employed worker, a dedicated self-employed mortgage can make it much easier. As a business owner, you will need to be able to show at least 2 years of acceptable financial statements from your business, and your income from it will be considered. It is also important to have a good credit score and a large enough down payment in order to qualify.

Requirements for a Self-employed Mortgage

- Good credit history & credit score,

- Confirmation of downpayment and closing cost funds,

- Purchase agreement with listing information,

- Social insurance number,

- Verification of assets,

- 2 years of financial statements,

- Most recent notice of assessment(s), and

- 3 months of recent bank statements

Meridian Flex Line Mortgage

A Meridian Flex Line Mortgage combines both a mortgage and a home equity line of credit (HELOC) to form a readvanceable mortgage product. You are able to borrow up to 80% of the home's value, and pay it back whenever you choose. As you are paying down your mortgage balance, your line of credit limit will automatically increase. This mortgage option can be added to existing variable rate and fixed rate Meridian mortgages, by adding it on when you are getting your initial mortgage. A Meridian Flex Line Mortgage can be a good option to help you do a renovation, pay for education costs, or make a big purchase with, all without having to refinance to access your equity.

Meridian Friends & Family Mortgage

Considering that rising home prices across Canada are making it much harder for first time home buyers to afford to buy a home, a Meridian Friends and Family Mortgage will allow you to split your mortgage with up to 4 people. You are also provided with the flexibility that only one owner needs to live in the home, which can make this a good way to get mortgage support from your parents if needed. The property will be jointly owned between the purchasers, meaning that the cost of the mortgage and down payment can be split equally between buyers, making payments more affordable. Considering that conflicts can arise when sharing ownership of a home, a formal legal agreement can help to smooth these conflicts over, and it is also important to agree upon terms of ownership before purchasing, such as who pays taxes, home insurance, and utilities.

Meridian Mortgage Features

Meridian offers multiple mortgage features that can help you pay off your mortgage quicker, provide you flexibility, and provide you with added peace of mind.

Meridian prepayment options

As a way to help you pay down your mortgage balance sooner, and to help you incur less interest costs, Meridian’s prepayment options include:

Lump-sum prepayment: Since you are able to prepay up to 20% of your Meridian mortgage balance each year without incurring a penalty, making a lump sum payment or paying more towards your mortgage whenever possible will drastically reduce your time to pay off your mortgage. This is because any additional prepayments will go directly to your mortgage balance, which reduces the interest amount you will pay over your term. Especially if you have money leftover in your budget, paying towards your mortgage balance will be more beneficial than keeping this money in a bank account.

Increasing your monthly mortgage payment: As over time you may get a raise, promotion, or may just have more financial flexibility, increasing your Meridian mortgage payment can help you become mortgage-free sooner. This is because every dollar extra you allocate towards monthly mortgage payments will go directly to reducing your mortgage balance. This will save you interest over the life of your mortgage, while still allowing you to remain within your budget. Even just increasing your mortgage payments slightly and progressively as you become more financially flexible will yield results over the long term, with drastically reduced interest expenses.

Meridian Mortgage Protection Insurance

Mortgage protection insurance can provide you with the confidence you may need to take on a mortgage, knowing that if anything happens to you, your family can remain in the home. Through Meridian’s Group Mortgage Protection Program, you will be able to insure your home for mortgage life, critical illness, disability, and job loss coverage. The cost of your mortgage protection insurance will be charged monthly along with your mortgage, and the premiums will vary depending on your age, mortgage amount, and types of coverage. This coverage can be added when you get your mortgage, meaning that if you are interested, ask your Meridian mortgage representative for more information.

Meridian Skip-A-Payment

This mortgage feature will allow you to skip 1 month of mortgage payments every 12 months, which can give you the flexibility and peace of mind you may need when taking on a mortgage. This feature can especially be useful in the event of a job loss, family emergency, or big expense, by providing you with 1 month of time away from making your mortgage payment. It is important however to try and not use this feature if you do not need to; you will still incur interest for the period, which will be added to your principal balance.

Meridian Payment Schedules

Meridian offers you the ability to choose how often to pay your mortgage: monthly, bi-monthly, bi-weekly, and weekly. This will allow you to not only choose a mortgage payment schedule that matches up with your employment payment schedule, but to also choose one that saves you interest over your mortgage term. The shorter the time period between mortgage payments, the less interest that will be incurred over the life of your mortgage, meaning that weekly or bi-weekly payments can help you pay your mortgage off sooner. As well, if you want to change your payment schedule up, Meridian will help accommodate this request.

Contacting Meridian

Meridian provides you with the benefit of convenience, with the option to contact the credit union over the phone at 1-866-592-2226, through their website, or to meet in person at one of the over 90 branches. Meridian’s large branch network is only in Ontario, with a presence all throughout the province. This includes 14 branches in Toronto, 4 branches in Ottawa, 3 branches in Hamilton, 4 branches in Brampton, 4 branches in Guelph, and 11 branches in the Niagara region. When getting a Meridian mortgage, meeting with an advisor at your local credit union branch is usually the best option, allowing you to benefit from the experience and ask questions.

How does Meridian differ from a bank or traditional mortgage lender?

Since Meridian is a credit union, it means that it is owned by the people that bank with it. This means that profit is not Meridian’s only goal, unlike with banks in Canada. Instead, Meridian and other credit unions focus more on customer service, helping out in their communities, and helping members to get the financing they need. As well, Meridian and other credit unions are not federally regulated, which means that they can still provide you a mortgage without requiring you to pass a mortgage stress test. This means that you are more likely to qualify for a mortgage at an institution like Meridian compared to one of the big 6 Canadian banks.

Pros & Cons of getting a Meridian mortgage

| Pros | Cons |

|---|---|

| Helpful and accommodative customer service that can help you get a mortgage in many situations | Meridian’s branch network is only in Ontario |

| Passing a mortgage stress test is not a requirement to getting a mortgage with Meridian | Other lenders may have more competitive mortgage rates than Meridian |

Disclaimer:

- Any analysis or commentary reflects the opinions of WOWA.ca analysts and should not be considered financial advice. Please consult a licensed professional before making any decisions.

- The calculators and content on this page are for general information only. WOWA does not guarantee the accuracy and is not responsible for any consequences of using the calculator.

- Financial institutions and brokerages may compensate us for connecting customers to them through payments for advertisements, clicks, and leads.

- Interest rates are sourced from financial institutions' websites or provided to us directly. Real estate data is sourced from the Canadian Real Estate Association (CREA) and regional boards' websites and documents.