Home Insurance in Canada 2026

What You Should Know

- Home insurance covers property damage, loss, theft, and personal liability

- Home insurance rates vary depending on your home’s value, location, and claims history

- Some of the largest insurance companies in Canada include the major banks, such as RBC Home Insurance, TD Home Insurance, and Scotia Insurance. Other major players include Desjardins, Aviva, CAA, Co-Operators, and Intact

Home insurance is a special form of insurance designed to protect your home and belongings in a potentially costly event, such as a fire or theft. By paying into policies through payments called premiums, homeowners will be able to make a claim for reimbursement should something happen in or at the property location. Home insurance isn't necessarily a requirement by law, however mortgage lenders require home insurance in order to protect their loan in case of an incident or accident with the property. Even those who own their home outright and are mortgage free choose to carry home insurance, as a way to protect what could be their biggest asset.

In addition to traditional home insurance for single-family homes, coverage options are also available for condo owners and renters, in the form of condo insurance and tenant insurance policies. Home insurance coverage comes in different forms, offering varying levels of protection depending on your needs. For example, if you live in a high-risk flood area, a standard home insurance policy may not include flood insurance. In that case, you might need to purchase additional flood coverage or a specific flood insurance endorsement to fully protect your home.

| Type of Coverage | What It Covers |

|---|---|

| Basic or Named Perils | You will only be covered for certain named risks on your property. This is usually the cheapest option, and provides only basic coverage. |

| Broad | This covers a broad variety of risks associated with your property, but it will only cover your personal contents for named hazards. |

| Comprehensive | This covers your property and contents from all risks, aside from some optional events such as sewer backups and earthquakes. It is the most expensive option. |

| Personal Liability | This provides coverage for events that occur at your property where you are held personally liable, such as for slip and falls. |

Home Insurance Endorsements

Can I increase my home insurance coverage?

You can add on additional coverage to protect against damage or loss that is not covered in your standard insurance policy. For example, if you were to live in an area that is classified as a flood risk, you may either be ineligible for flood protection or may need to get this special coverage added on.

Insurance add-ons, called insurance endorsements or riders, can include coverage for earthquakes, floods, sewer back-ups, and more. Other endorsements might include coverage for home-based businesses, such as for work equipment or computers inside your home. Specific items can also be named and covered, such as high-value jewelry, bicycles, memorabilia, and art.

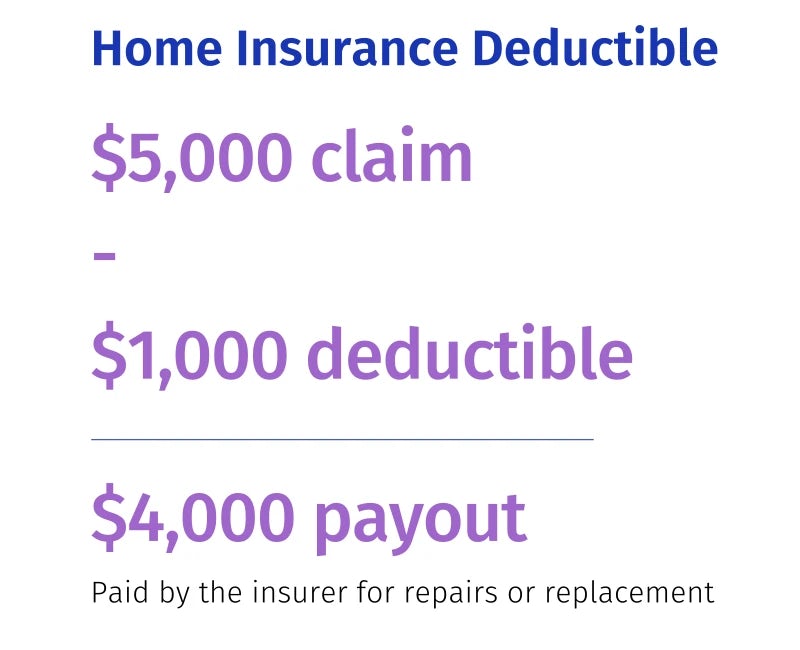

The way home insurance works is if you make a claim, you will have a minimum out-of-pocket expense, called a deductible. Since a higher deductible saves the insurance company money with the homeowner covering some of the cost, a higher deductible on your policy will usually mean lower monthly premiums. As well, a higher deductible will mean that smaller incidences that cost less than the deductible will not be paid by the insurer.

Factors That Affect Your Quote

The cost of your insurance coverage may be affected by: your type of coverage, home location, replacement cost of your home, past claims history, home age, property style, roof, if you have a hot tub or pool, renovations on your home, your credit score, and the valuables you choose to insure.

The following chart shows these 10 factors, with a description of how they affect your premiums:

| Factors | How It Affects Your Premiums |

|---|---|

| Location | The neighbourhood you live in, including the crime rate, your proximity to water, and potential risks for your policy in the area will affect the rate you will be offered. |

| Replacement Cost | This is the cost for you to rebuild your home. This will differ from the market value, and the higher the replacement cost, the higher your premiums will likely be. |

| Past Claims History | The amount of claims that you file will lead to a potentially higher premium. This is because the insurance company will deem you as likely to file even small claims in the future, making it more expensive to cover your house. |

| Age of Your Home | Old homes tend to have a higher chance of something going wrong, whether that be in the form of electrical, plumbing or structurally. This will mean higher risk and therefore higher premiums. |

| Credit Score | Insurance data shows that your credit score is correlated to your insurance risk. The better your credit score, the better rate you will likely receive. |

| Swimming Pool & Hot Tubs | With pools and hot tubs comes the risk of potential liability, occurring from injuries or drowning. Although safety precautions such as fences around the water can make your pool safer, the added risk of a pool or hot tub will still lead to higher premiums. |

| Renovations | As renovations tend to add to the value of your home, it will mean a higher home replacement cost and therefore a higher cost to insure. |

| Property Style | Depending on what type of property you live in (townhouse, condo, single family home) you will have different risks that the insurance company will consider. |

| Roof | The style and age of your roof will affect the potential for leaks and other costly issues with your house. |

| Valuables | Anything of value within your home that you insure, including jewelry, will increase the replacement cost in the event of an incident. Higher replacement costs mean higher premiums. |

When comparing insurance rates, the amount you pay monthly isn't the only detail to consider. Getting a cheap home insurance rate may save you money in the short term, however it could lead to higher costs over the long term, such as through a higher deductible and less coverage. This is why home insurance should be compared by both cost and the extent of coverage. The main 4 different types of coverage for home insurance are:

- Basic or Named Perils

- Broad

- Comprehensive

- Personal Liability

When deciding on what options you want to include in your coverage package, it all comes down to your level of protection and comfort. If you are comfortable with covering some out-of-pocket expenses and are less concerned about potential incidents, a more basic and affordable policy may suit your needs. However, If you have a home that you are very worried about something happening in, a more comprehensive package may fit your needs better. If your house is older as well, it will be more likely that something adverse occurs, making comprehensive insurance that much more important.

Home Insurance Providers in Canada

Here’s an overview of major home insurance providers in Canada and what you can expect when getting a quote:

Get a free Intact home insurance quote online through YouSet by answering a few simple questions about your home size, type, and insurance history. Quotes can typically be obtained in minutes.

Get a home insurance quote within minutes. Their platform lets you adjust property details and immediately see how your insurance premiums may change — a useful feature for home buyers comparing different properties.

Taking under 5 minutes, Scotia provides the option to adjust and re-calculate your quote based on specifications you want to include or remove. This can make designing the quote to fit your needs very simple.

Sonnet is quick and easy; they ask a few questions on the type of house you own, including the size, when it was built, and what the home is used for. Then, Sonnet shows you 3 options in terms of coverage, from basic coverage to comprehensive coverage.

Using your basic personal information, along with some general questions about your property (property age, value of belongings), you are able to get a detailed quote. TD’s process takes around 5 minutes to complete, and shows you all the different options for coverages, from more basic coverage to comprehensive coverage.

With your property information, including information on your past claims and property features, RBC Home Insurance provides a detailed quote that takes around 5 minutes to complete. Once you reach the quote stage you are able to customize the policy, including your personal liability coverage limit and your deductible limit. You are also able to add on different types of coverage options. These coverages can include: sewer backup coverage, jewelry protection coverage, and identity theft protection.

With some general questions about your property, including size, claim history, insurance history, and other details, Allstate takes about 5 minutes to get a quote. Once you get a quote, having someone from your local office get in touch with you is simple, by clicking an option to allow an agent to contact you.

With the simplicity of being able to adjust the policies while seeing how it affects your quote, CAA’s quote system is very user friendly. By answering some general questions about both the home and yourself, you can have a quote in about 5 minutes.

Similar to all the other quotes, Aviva allows you to get a quote in around 5 minutes. From your quote screen, you are able to easily adjust policy details, and can save on your premiums by purchasing online.

Although quick and easy, Desjardins will only grant you a quote with the acceptance of a credit check. They also ask for more details than some of the other quote calculators, including details such as your home's heating source, exterior siding and roofing material. Once you reach your quote, the option to adjust the policy and schedule a call with an agent allows easy next steps in the process.

With similar questions and a similar interface as Desjardins, CIBC offers detailed quotes and the option to adjust your policy while seeing how it affects your quote.

How Can I Lower My Home Insurance Premiums?

Just like comparing mortgage rates in order to get the best deal, you should compare home insurance providers to see who can offer the best coverage at the lowest rate. Getting quotes from multiple insurance companies can be made easier by using an insurance broker. If not, you can easily get multiple quotes online in minutes. Remember to check what the policy will cover, rather than just looking at which company will offer the lowest insurance premium. Important things to look out for include the size of the deductible, what is excluded, and the coverage amount.

One way to lower your home insurance premium is by increasing your deductible. Agreeing to have a higher deductible, such as $1,000 instead of $500, can let you reduce your insurance premium. That's because you will be paying more should you need to file a claim with your insurer.

Another way to reduce your premium is by qualifying for discounted rates. Some insurers provide discounts for those that bundle other insurance policies together, such as life insurance or auto insurance. You may also qualify for discounts for certain safety features, such as if you have a monitored alarm system or if you have fire extinguishers in your home.

There are some things that you can't change, such as your home's location. For example, increasing costs of natural disasters have caused the average home insurance premium in Alberta to increase from $741 in 2011 to $1,779 in 2021. Avoiding homes in disaster-prone areas, such as floodplains, can let you avoid steep insurance premiums.

Provincial Considerations for Home Insuranc

When it comes to home insurance in Canada, the risks you face vary greatly depending on the province you live in. Each region faces unique challenges that can affect the type and cost of your insurance coverage.

Water damage in Ontario is the number one cause of home insurance claims, even above fire-related claims. Most standard home insurance policies do not cover overland flooding, sewer backups, or storm surges. Homeowners in Ontario should consider adding sewer backup coverage and overland water protection to their policies to guard against costly flood-related damages.

Quebec is home to many older properties, particularly in cities like Montreal and Quebec City. Aging electrical and plumbing systems increase the risk of incidents that may not be covered under a basic policy. Additionally, due to heavy snowfall, homeowners could be liable for slip-and-fall accidents. Basic property coverage, along with proper liability protection, is highly recommended.

British Columbia faces the highest earthquake risk in Canada, especially in areas like Vancouver and Victoria located along major tectonic plate boundaries. While earthquake insurance is an optional add-on, it is highly recommended. Homeowners should also consider expanding their coverage limits to account for higher rebuilding costs, which are influenced by stringent seismic building codes.

Forest fires and flood risks have the two biggest impacts on homeowner insurance in Alberta. This is even true in urban areas of Alberta, such as Calgary. This makes flood insurance potentially worthwhile as a way to protect yourself from floods that can cause massive damage to your home.

Flooding and hurricane risks are important to consider, especially in Halifax and Dartmouth, two of Nova Scotia's biggest cities on the Atlantic Ocean. This may make getting comprehensive coverage along with storm surge coverage essential in your policy.

New Brunswick experiences inland flooding and strong windstorms. Homeowners are encouraged to consider windstorm coverage, sewer backup insurance, and overland water protection to mitigate risks.

Increasing storm activity makes flood insurance a smart addition for PEI homeowners. Some insurance providers, like The Co-Operators, offer storm surge insurance to cover damages caused by ocean-related flooding.

As the only province not to allow the use of your credit score in determining your insurance rate, Newfoundland will have more standard rates throughout the province. Being in the Atlantic Ocean, Newfoundland is at higher risk of flooding, wind damage, and hurricane damage.

Homeowners near waterways, such as the Red River, should strongly consider overland water coverage and storm surge protection to protect against spring floods.

Extreme cold in Saskatchewan creates a high risk of pipe damage. Proper maintenance is crucial, as insurers are less likely to cover slow-developing issues caused by poor upkeep. Adding sewer backup coverage is also recommended to protect against water damage during severe weather.

How Do You Make a Home Insurance Claim?

The important thing to remember when making a claim is to have documentation and proof to back up your claim and to report the incident as soon as possible.

If there has been an incident that can be covered by your home insurance, you can decide to make a claim with your insurance provider. However, not all claims may make sense. Your home insurance may have a deductible that would make any smaller claims not worth it, as the deductible that you would need to pay may be higher than the amount you may receive from a claim.

If your claim is large enough to be worthwhile, you may also want to consider its possible effects on your insurance premiums. Making frequent claims may cause your insurance premiums to go up. The first step to making a claim is reporting the incident to your insurance provider. You should take pictures of the damage, or if there has been a theft, have a police report.

You will be assigned someone from your insurance provider who will work with you through your claims process. They'll help you find temporary accommodation if your home has been damaged. They will also arrange to have repairs completed, or suggest contractors that can complete the work.

How Will My Home Insurance Claim Be Paid?

If your home insurance claim has been approved, your insurance provider will pay out your claim. If your claim involves repairs, your insurance provider will pay the cost of repairs directly to you if you paid contractors for the repairs out-of-pocket. This can be done through a cheque or bank transfer.

For instances where the insurance provider's contractors completed the repairs, then the provider will pay the contractors directly. If the claim will be paying for items that will need to be replaced, you will be paid the replacement cost of the items. Your final payout will be reduced by the amount of your deductible.

For example, let’s say that there was water damage in your bathroom from a small leak in your sink. The cost of repairs is $5,000, and your home insurance policy has a $1,000 deductible. You will need to pay $1,000 to your insurer, while your insurer will pay $5,000 for repairs.

What happens if my claim is denied?

If your home insurance claim has been denied, you can choose to dispute the denial with your insurance provider. If your claim was denied due to a lack of evidence, you can try providing additional proof or documentation. If your claim still hasn't been resolved, you can appeal to your insurance provider's Ombudsman. The Ombudsman will investigate and help mediate the dispute.

If that still doesn't provide you with a satisfactory resolution, you can ask for help from third parties. The General Insurance OmbudService (GIO) is independent and is free to use. They can provide mediation with your insurance company and will act as a neutral third party. The GIO can escalate to a non-binding adjudication.

Beyond that, you can contact your province's insurance regulator. For example, if you are in Ontario, you can file a complaint with the Financial Services Regulatory Authority of Ontario (FSRA). You may also choose to take legal action.

Disclaimer:

- Any analysis or commentary reflects the opinions of WOWA.ca analysts and should not be considered financial advice. Please consult a licensed professional before making any decisions.

- The calculators and content on this page are for general information only. WOWA does not guarantee the accuracy and is not responsible for any consequences of using the calculator.

- Financial institutions and brokerages may compensate us for connecting customers to them through payments for advertisements, clicks, and leads.

- Interest rates are sourced from financial institutions' websites or provided to us directly. Real estate data is sourced from the Canadian Real Estate Association (CREA) and regional boards' websites and documents.