MCAP Mortgage Rates & Reviews

MCAP Background

MCAP is one of the largest independent mortgage finance companies in Canada, with over $150 billion in assets under management. MCAP offers mortgages through mortgage brokers across Canada, including a variety of services through its three lines of businesses: residential mortgages, commercial mortgages, and development finance. MCAP residential mortgages are known as RMG mortgages. MCAP has over 1500 employees in 10 offices across major cities in Canada, and has over 400,000 mortgage accounts.

MCAP Fixed Mortgage Rates

An MCAP fixed rate mortgage will protect you from the risks of future interest rate fluctuations by allowing you to keep the same interest rate as when you got your mortgage originally. This may give you extra peace of mind, especially if you are getting a large MCAP mortgage or if you are a first-time home buyer who is new to having a mortgage. With MCAP mortgage rates and mortgage rates across lenders being at record low levels, locking in your mortgage rate over your term can guarantee you are taking advantage of these low rates.

MCAP Variable Mortgage Rates

An MCAP variable rate mortgage will give you the benefit of a lower mortgage rate if interest rates are to fall in the future. This is because your variable mortgage rate is set in relation to the prime rate, meaning that if the prime rate falls, so will your rate. The same is also true if the prime rate rises, where you will be paying more of your monthly mortgage payment to interest. However, you will still have the same mortgage payments even if your mortgage rate rises or falls; the only difference will be how much of your payment goes towards your principal versus your interest.

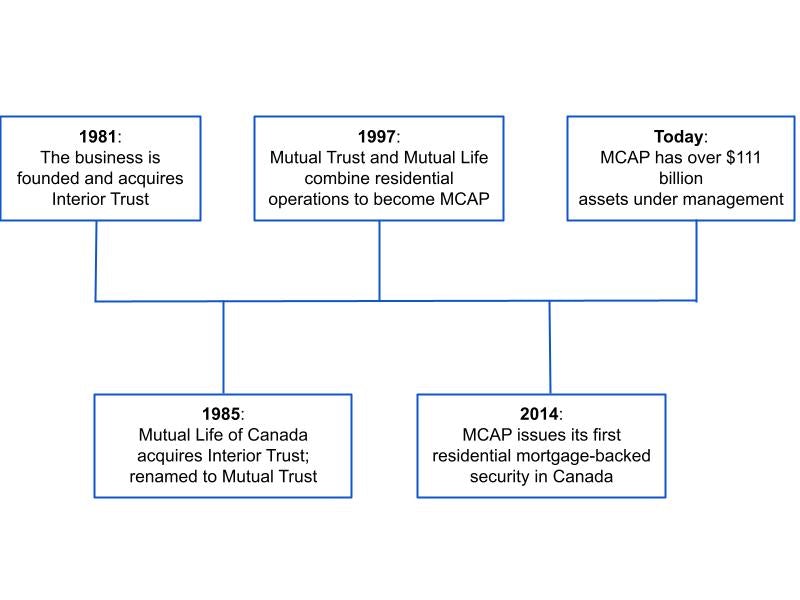

MCAP History

MCAP Mortgage Break Penalty

| Bank or Lender | Variable Rate Mortgage | Fixed Rate Mortgage |

|---|---|---|

| 3 Months’ Interest | Greater of 3 Months’ Interest or the IRD amount |

MCAP calculates your interest rate differential mortgage break penalty by finding the difference between the MCAP posted rate for the time remaining on your mortgage, and your current mortgage rate. This difference is then multiplied by the amount of time left on your mortgage to get the IRD amount.

MCAP Mortgage Prepayment Calculator

Are you looking to pay off your mortgage early? Or refinance the terms of your mortgage at a lower interest rate? Maybe you sold your home. Whatever the case, you most likely will have to pay a mortgage break penalty set by your lender. Whatever the situation, our calculator will help you determine the cost to break your mortgage so you can be confident about your mortgage decisions.

What is the remaining balance on your mortgage?

What is the term-length and type of your current mortgage?

What is your current mortgage interest rate?

If applicable, what was the rate discount you received when you signed your current mortgage agreement?

When did your current mortgage start?

Is the Property:

Who is your current mortgage lender?

What is MCAP's current interest rate for a 1-year fixed rate mortgage?

What would you like to do?

Please complete all fields before calculating.

By using the calculator, you agree to our Terms of Service

MCAP Mortgage Products

Small rental property mortgages

For non-owner occupied investment properties with 4 or less units, MCAP offers both a 5-year fixed mortgage and a 5 year convertible mortgage. Properties that will be eligible to purchase with a rental property mortgage include:

- Condo’s,

- Single family homes,

- Duplexes,

- Triplexes, and

- Quadplexes

MCAP rental property mortgages do have restrictions, including:

- A maximum of 4 rental properties per borrower and a maximum of 2 with MCAP, and

- Properties need to be located at least 30 kilometers from a population centre larger than 25,000 people

Overall, if you do qualify, you will be able to get an MCAP mortgage for up to 80% of the properties value, between $50,000 and $800,000 for insured mortgages, and 70% of the properties value, between $50,000 and $500,000 for uninsured mortgages.

VIP-M-Power mortgage

This MCAP mortgage product will offer you the benefit of a variable rate mortgage, where your mortgage rate will fluctuate with the prime interest rate, while giving you the ability to convert it to a fixed rate mortgage at any time. This is a very useful product for homebuyers who are expecting interest rates to be lower during their term, with the ability to have your MCAP mortgage rate fall along with the prime rate. As well, you will have the peace of mind that if during your term you want to have a fixed interest rate, you are able to convert your mortgage to one. MCAP offers multiple amortization periods as well, with the ability to have a 15 to 30 year amortization for uninsured mortgages, and a 15 to 25 year period for insured ones.

MCAP Fusion Mortgage

This MCAP mortgage option acts as a readvanceable mortgage, where you are able to have access to a home equity line of credit (HELOC), and the balance automatically increases as you pay down your mortgage. This can save you time and money rather than needing to refinance when you need money. Potential uses for the line of credit portion may include:

- Consolidating your debts,

- Investing in other assets or properties,

- Covering expenses, and

- Saving for a large purchase, such as a car or boat

The line of credit portion of the MCAP Fusion mortgage can be paid back at any time, and you are able to borrow up to 65% of your home equity.

Renewing your MCAP mortgage

About a month prior to your mortgage term coming due, MCAP will send you information, including mortgage rates and terms that you will be able to renew your mortgage at. However, it still is a good idea to shop around to see if there are any better renewal rates available. This can include meeting with a mortgage broker, or meeting with and negotiating with multiple lenders to find the best renewal rate available.

MCAP mortgage refinancing

This process can be done both online and over the phone with an MCAP representative, where you will submit your application to refinance, and you will hear a decision. Common fees involved when refinancing may include:

- Application fees,

- Discharge fees,

- Prepayment penalties, and

- Legal fees

To qualify, you will need to have paid your monthly mortgage payments on-time and in full, and meet the necessary income, equity, and credit history requirements.

MCAP Mortgage Features

MCAP Port your Mortgage

With this mortgage feature that MCAP offers, you will be able to move your existing mortgage to a new home. This can make the purchase and financing process involved in buying a new home simpler, while even allowing you to increase your mortgage amount while porting the original mortgage and rate. If you are purchasing a home that needs a smaller mortgage, MCAP also allows you to decrease your portable mortgage.

MCAP Mortgage Protection Insurance

MCAP offers two forms of mortgage protection insurance, with both the option to cover your mortgage in the event of death, and in the event of disability. Mortgage life insurance will cover you for up to a $750,000 mortgage, while disability protection insurance will cover your monthly mortgage payments, up to $4000. To be eligible, you will need to be ages 18 to 64, and you will be able to cover all or 50% of your mortgage balance, depending on your coverage. MCAP offers this coverage through Sun Life Insurance, however you will still pay the monthly premiums with your mortgage.

Mortgage prepayment and payment features

MCAP offers multiple ways to help save you money on monthly interest payments and to help you pay off your mortgage sooner.

Lump-sum prepayment: You are able to prepay up to 20% of your original mortgage principal each year you are holding your MCAP mortgage. This will allow you to meaningfully reduce your principal balance that interest accrues on, leaving you in a more flexible financial situation.

Increase your monthly payments: MCAP allows you to increase your monthly MCAP mortgage payments by up to 20% each year, which will help you contribute meaningfully to your mortgage balance. All of this 20% increase will go directly to your principal, which is similar to a lump sum payment but may be easier to take advantage of.

Accelerate your payment frequency: You are able to speed up the frequency that you pay your mortgage at, from monthly to bi-weekly. This will result in you paying off your mortgage much sooner, and with less total interest being paid. Especially if you are paid bi-weekly anyways, this can be a great way to budget easier and reduce your total cumulative interest payments over your mortgage's life.

MCAP property tax payments

Paying your property taxes through MCAP is required on most mortgages, and is also offered to those who are not required in their mortgage contract to pay property taxes through MCAP. The process of paying these taxes through MCAP works by having a portion of your property tax estimate being collected each month and set aside in a property tax account. MCAP will then use this money to pay your municipality on your behalf when the assessment comes due. This feature can help streamline payments and make paying much easier to plan for.

My MCAP

After getting an MCAP mortgage and registering online, you will be able to use the My MCAP customer portal to get information on your mortgage and to perform self-serve tasks relating to your mortgage. Some of the features on the My MCAP platform include:

- Making prepayments,

- Withdrawing from a HELOC,

- Getting your mortgage statements, information on your balance, and payment details,

- Reviewing your property tax information, and

- Finding answers to common questions under the “frequently asked questions” section

MCAP Contact

MCAP offers multiple ways to get into contact with a representative, with the easiest one being directly by phone at 1-800-265-2624. The other way you can get in touch with the company is through submitting an MCAP contact request on the contact us page of the website. To get more information on your current MCAP mortgage or to change an aspect about it, your “My MCAP” online portal will be a good way to get the information or responses you need. Finally, with 8 residential mortgage offices across Canada in Toronto, Montreal, Halifax, Regina, Waterloo, Edmonton, and Vancouver, getting in contact and meeting with someone in the office may also be an option.

MCAP Reviews

Helping over 225,000 homeowners across Canada, MCAP is one of the largest independent mortgage financing companies in the country. The following reviews are here to give you a better understanding of what the overall service level is like working with MCAP for a mortgage.

Google Reviews for MCAP Head Office (Toronto): 3.2/5 from 124 reviews

Google Reviews for MCAP Waterloo: 3.8/5 from 11 reviews

| Pros | Cons |

|---|---|

| MCAP offers many flexible mortgage features and mortgage products for home buyers. | MCAP is a mortgage company and will not be able to meet all your non-mortgage related financial needs. |

| My MCAP can be very helpful and help you manage aspects of your mortgage from home. | You will require a mortgage broker to get a mortgage with MCAP. |

Disclaimer:

- Any analysis or commentary reflects the opinions of WOWA.ca analysts and should not be considered financial advice. Please consult a licensed professional before making any decisions.

- The calculators and content on this page are for general information only. WOWA does not guarantee the accuracy and is not responsible for any consequences of using the calculator.

- Financial institutions and brokerages may compensate us for connecting customers to them through payments for advertisements, clicks, and leads.

- Interest rates are sourced from financial institutions' websites or provided to us directly. Real estate data is sourced from the Canadian Real Estate Association (CREA) and regional boards' websites and documents.