ATB Financial Mortgage Rates & Reviews

ATB Financial Background

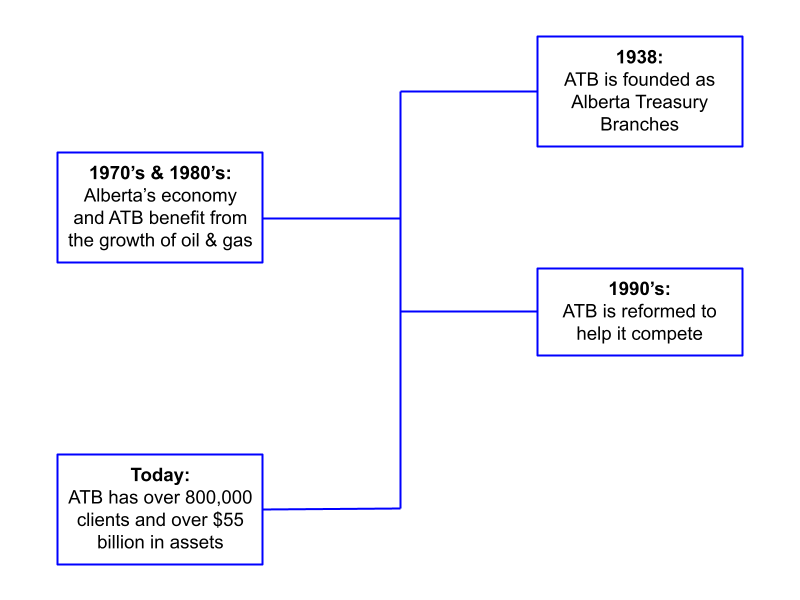

ATB Financial is a financial institution that is operating as a crown corporation, and is owned by the province of Alberta. Since ATB only operates in the province of Alberta and is owned by Alberta, the Alberta government guarantees the deposits. ATB offers a variety of services and credit products, with business lines in: personal banking, commercial banking, mortgage lending, insurance, and wealth management. Currently ATB Financial is the largest financial institution in Alberta, with over $55 billion in assets and over 5,000 employees. ATB is headquartered in Edmonton, Alberta, and serves more than 800,000 people through its over 170 branches province-wide.

ATB Financial Fixed Mortgage Rates

An ATB fixed rate mortgage will provide you with the benefit of not having to worry about your ATB Financial mortgage rate rising during your term, with your interest rate locked-in for the entire term. This makes getting a fixed rate mortgage popular with first time home buyers in Alberta, with the certainty that it brings. Especially considering that ATB mortgage rates are at record low levels and the future may bring slightly higher interest rates, a fixed rate mortgage will help you to benefit from low rates for your entire term.

| Term | ATB Rate | Canada's Lowest Rate |

|---|

The rates shown are for insured mortgages with a down payment of less than 20%. You may get a different rate if you have a low credit score or a conventional mortgage. Rates may change at any time.

ATB Financial Variable Mortgage Rates

An ATB Financial variable mortgage will have its interest rate move in relation to the prime rate. This means that if the prime rate rises, your ATB mortgage rate will also rise, and if the prime rate falls, your mortgage rate will fall. This means getting an ATB variable mortgage rate can be a good option to get you a lower mortgage rate if you expect interest rates to fall. The way that a variable rate mortgage will work is that you will still pay the same monthly mortgage payments no matter what happens with your ATB Financial mortgage rate. However, the amount of principal balance you will pay towards your mortgage will fluctuate with the interest rate.

| Term | ATB Rate | Canada's Lowest Rate |

|---|

The rates shown are for insured mortgages with a down payment of less than 20%. You may get a different rate if you have a low credit score or a conventional mortgage. Rates may change at any time.

ATB Financial Prime Rate

ATB Financial’s prime rate is the benchmark the institution uses when deciding on mortgage rates and the interest rate on other credit products. As the prime rate moves alongside the overnight interest rate which is set by the Bank of Canada, variable mortgage rates will also fluctuate. A mortgage rate is priced using a spread between the prime rate. This spread may be negative, meaning that you will have an interest rate less than the prime rate, or may be positive, where your interest rate will be greater than the prime rate.

Current ATB Financial Prime Rate: 4.45%

ATB Financial Mortgage Features & Products

Payment frequency options

ATB Financial offers multiple mortgage payment options, including weekly, bi-weekly, and monthly payments. This will allow you to match up your mortgage periods with your employment payment frequency, helping you budget easier for your ATB Financial mortgage. As well, if you are able to do weekly or even bi-weekly payments, you will have the ability to save money on interest payments throughout your mortgage term. This is because you are reducing your principal balance more often, and therefore reducing your total interest paid.

ATB prepayment options

With a prepayment allowance of 20% of your original mortgage balance each year, you will be able to pay off your ATB mortgage either by increasing your monthly payments, or by making lump-sum payments. This prepayment allowance is higher than many of the big 6 banks, and can allow you to pay off your mortgage sooner and can help you do this without having to pay a mortgage break penalty to ATB. Utilizing this prepayment allowance is helpful, especially if you have extra money leftover throughout the year or each time you pay your mortgage.

ATB Financial Loan Protection Insurance

ATB offers mortgage life insurance and disability insurance, which will cover all or part of your mortgage in the event that your policy is triggered. The cost for coverage will depend on your age and the size of your initial mortgage amount, and you will only need to answer a few health questions to qualify. The main benefit of this add-on feature is the peace of mind it can give you, knowing that your mortgage will be covered if anything happens to you.

ATB Residential Outbuilding Mortgage

If you are planning on expanding your home or adding another structure to your property, an outbuilding mortgage is a useful option. ATB Financial is the first in Canada to offer this kind of lending product, and garages, suites, and shop-houses are available to be financed with this product. The way it works is that these types of outbuildings will be eligible for valuation and financing if they are: permanent, for residential use, designed and constructed well, and are marketable and appraised while financing.

ATB Financial Home Equity Line of Credit(HELOC)

An ATB Financial HELOC can help you to access the equity from your home without needing to sell or refinance. Your HELOC will allow you to borrow up to 65% of your home equity, with the benefit of a flexible repayment schedule. Some costs involved may include the cost of a home appraisal, among other associated costs. With the lower interest rate associated with a HELOC compared to a normal unsecured line of credit because of it being secured by your home, it can be a great option for funding a renovation, for investing, or to make a large purchase.

ATB Financial Branch Locations

ATB Financial has over 170 branches located throughout the province of Alberta, with 24 branches in Calgary, 32 branches in Edmonton, and 2 branches in Red Deer. The head office for ATB FInancial is at 10020 100th Street North West, Edmonton, Alberta. With branch locations all across the province, in addition to a large presence in the major cities, ATB Financial makes meeting with a mortgage representative easy.

Contact ATB Financial

Aside from visiting your local ATB Financial branch, you are also able to get help over the phone, and by email. The phone number to speak to the client care team at ATB Financial is 1-800-332-8383, and you can email through the ATB client service portal. On the ATB website, you will also be able to book an appointment at your local branch, chat with a virtual assistant, and find branch locations across the province.

Disclaimer:

- Any analysis or commentary reflects the opinions of WOWA.ca analysts and should not be considered financial advice. Please consult a licensed professional before making any decisions.

- The calculators and content on this page are for general information only. WOWA does not guarantee the accuracy and is not responsible for any consequences of using the calculator.

- Financial institutions and brokerages may compensate us for connecting customers to them through payments for advertisements, clicks, and leads.

- Interest rates are sourced from financial institutions' websites or provided to us directly. Real estate data is sourced from the Canadian Real Estate Association (CREA) and regional boards' websites and documents.