National Bank Mortgage Rates & Reviews

National Bank Background

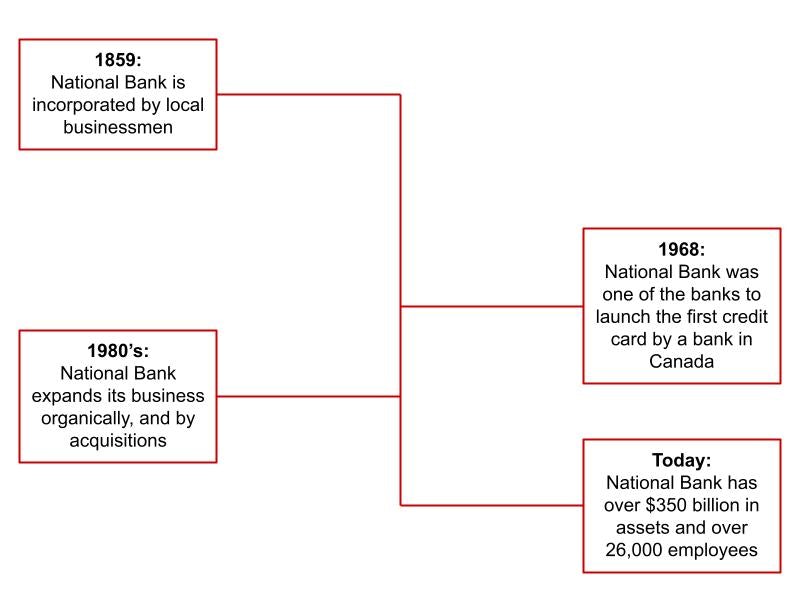

National Bank (TSE: NA) is the sixth largest bank in Canada and has its headquarters in Montreal, Quebec. Through its branches across Canada, National Bank services 2.8 million customers. The majority of National Bank’s revenue is earned through its personal and commercial banking division, while National has been growing its wealth management and financial market services over the last number of years. National Bank currently employs 31,000 people with most being located in Quebec, where it is one of the largest banks. In fact, more than 50% of National Bank’s business is located in Quebec. In total, National Bank has over $420 billion in assets.

National Bank Fixed Mortgage Rates

A National Bank fixed-rate mortgage will shield you from the risk of future interest rate fluctuations by providing you with a specific interest rate for the entire term. This can give you peace of mind, especially as a new homeowner, which makes getting a fixed mortgage rate much more common than variable-rate mortgages. If you are arranging a new National Bank mortgage for a future or current home, your National Bank mortgage rate can be guaranteed or locked in for a period of up to 90 days. This means that if interest rates are to go up during that time, you will still be guaranteed the lower rate.

| Term | National Bank Rate | Lowest Rates of Big 6 Banks |

|---|

The rates shown are for insured mortgages with a down payment of less than 20%. You may get a different rate if you have a low credit score or a conventional mortgage. Rates may change at any time.

National Bank Variable Mortgage Rates

With a National Bank variable rate mortgage, your interest rate will move in tandem with changes in the National Bank prime rate and so will your National Bank mortgage payments. If the National Bank’s prime rate goes up, your mortgage payments will increase, and they will reduce if the prime rate decreases. This means that getting a variable National Bank mortgage rate can be beneficial if you believe that interest rates will drop during your term.

| Term | National Bank Rate | Lowest Rates of Big 6 Banks |

|---|

The rates shown are for insured mortgages with a down payment of less than 20%. You may get a different rate if you have a low credit score or a conventional mortgage. Rates may change at any time.

National Bank History

National Bank Mortgage Break Penalty

A National Bank mortgage break penalty will be incurred when you decide to end your mortgage agreement and repay your mortgage balance before your term is up. This will result in a potentially high fee, with National Bank charging 3 months worth of interest on any variable rate mortgages that are broken, and the greater of 3 months of interest or the amount determined through a process called the Interest rate differential (IRD) method for a fixed rate mortgage.

| Bank or Lender | Variable Rate Mortgage | Fixed Rate Mortgage |

|---|---|---|

| 3 Months’ Interest | Greater of 3 Months’ Interest or the IRD amount |

The interest rate differential method determines your mortgage break penalty by finding the difference between the posted rate for the time remaining on your mortgage, and your current mortgage rate. From there, multiplying the difference between the posted rate and your current rate by the amount of time left on your term will equal your mortgage break penalty.

National Bank Mortgage Prepayment Calculator

Are you looking to pay off your mortgage early? Or refinance the terms of your mortgage at a lower interest rate? Maybe you sold your home. Whatever the case, you most likely will have to pay a mortgage break penalty set by your lender. Whatever the situation, our calculator will help you determine the cost to break your mortgage so you can be confident about your mortgage decisions.

What is the remaining balance on your mortgage?

What is the term-length and type of your current mortgage?

What is your current mortgage interest rate?

If applicable, what was the rate discount you received when you signed your current mortgage agreement?

When did your current mortgage start?

Is the Property:

Who is your current mortgage lender?

What is National Bank's current interest rate for a 1-year fixed rate mortgage?

What would you like to do?

Please complete all fields before calculating.

By using the calculator, you agree to our Terms of Service

Other National Bank Mortgage Options

National Bank self-employed mortgage

Considering that getting a mortgage when you're self-employed may be tricky, National Bank’s self-employed mortgage can help. This mortgage is primarily for self-employed people who may not have standard proof of income. To be eligible, you must have been self-employed for over 2 years and have displayed good financial and credit management over this time period. With a National Bank self-employed mortgage, you will also need a down payment of at least 10% and are only eligible for properties with no more than two dwellings.

National Bank second property mortgage

If you are looking to purchase a second home through National Bank, you are able to get up to 95% of the property financed, with mortgage default insurance, if it can be used around the year. For seasonal cottages, you can get financing of up to 90% of the value of the property. This means that it can be a good way to purchase an investment property or a cottage. Also, using your existing home equity through refinancing or a HELOC can be a source of funds for a down payment.

National Bank All-in-One

This product acts as a readvanceable mortgage product, where you are able to use your existing home equity through a home equity line of credit. Instead however, since it is already set up when you get your mortgage, you will not have to apply for another loan for the line of credit. As well, over time as you pay down your mortgage you will have more equity to access in the form of the line of credit portion.

National Bank Mortgage Features

National Bank mortgage protection insurance

Considering that if anything is to happen to you as a borrower on a loan, it may impact the ability for your family to remain in their home. Mortgage protection insurance will help to keep your family in your home if something happens, with coverages such as mortgage life insurance, critical illness insurance, and disability insurance. Depending on what type(s) of coverages you choose, you may be able to cover your mortgage amount for up to $1,000,000. To be eligible, you will need to be between the ages of 18 and 64, and have a place of residence in Canada or the USA.

National Bank prepayment options

In order to help you pay off your mortgage sooner, National Bank offers 3 helpful mortgage features:

Add additional payments: National Bank allows you to make an additional mortgage payment on each payment date, which will speed up how fast you pay your mortgage exponentially. The benefit of this is that 100% of your additional monthly payments will go towards your mortgage principal, saving you interest throughout your term.

Increase your payment frequency: By speeding up how often you pay your mortgage from monthly to weekly or bi-weekly payments, it will result in less interest accruing over time. This is because more frequent payments will mean that you are reducing your mortgage balance more often, leaving less of a balance for interest to accrue on.

Make a lump sum payment: National Bank allows you to prepay up to 10% of your initial mortgage principal balance every year. This is one of the lowest among Canadian banks, with all of the big 6 banks being between 10% & 20% of your initial balance yearly. If you plan on paying your mortgage off more aggressively, getting an open mortgage may be a good option.

National Bank property tax payments

Depending on your mortgage agreement with National Bank, you may be required to pay your property taxes through National Bank. Even if you are not required to pay through National, you will have the option to, as a way to simplify your property tax payments. This is because by paying through your monthly mortgage payments rather than at the end of the year, you are better able to budget, and will not forget about paying. However, a major downside is that you will not earn interest on the property tax amount as you wait to pay it, which you would if you kept it in your bank account before paying it.

Contacting National Bank

With National Bank’s wide reaching branch network and online presence, speaking with a mortgage representative can be made easy. Over the phone, a mortgage advisor can be contacted by calling 1-855-755-9533, and choosing option 4. As well, through the National Bank website you are able to locate branches in your area with the National Bank branch locator, or request an appointment by filling out an online form through the website.

Disclaimer:

- Any analysis or commentary reflects the opinions of WOWA.ca analysts and should not be considered financial advice. Please consult a licensed professional before making any decisions.

- The calculators and content on this page are for general information only. WOWA does not guarantee the accuracy and is not responsible for any consequences of using the calculator.

- Financial institutions and brokerages may compensate us for connecting customers to them through payments for advertisements, clicks, and leads.

- Interest rates are sourced from financial institutions' websites or provided to us directly. Real estate data is sourced from the Canadian Real Estate Association (CREA) and regional boards' websites and documents.